In our previous columns, we’ve often addressed a major pitfall for bond investors: the attempt to out-guess the market. Many are frustrated with current yields and decide to keep their investment dollars parked in money market funds, waiting for long-term interest rates to become more attractive. Currently, a staggering $7.186 trillion is idly sitting in US money-market funds, as investors wait for the “right” moment to enter the market.

However, this strategy frequently overlooks the hidden cost of waiting that can be significant. Like well-known risks such as credit and market risk, the decision to delay investing could have serious consequences, including lost time and money that may never be reclaimed.

If you have funds set aside for tax-free bonds, it could be the perfect opportunity to put them to work. Quality long Munis remain near 5%, with over a 7% taxable equivalent for high-tax state residents. The potential returns from these investments could diminish considerably with further delays. It’s important not to underestimate the risks of remaining on the sidelines in hopes of better rates.

Think about investing now versus waiting. When funds are in a money market, they aren’t achieving optimal returns. If rates decline, you not only lose out on today’s benefits but also risk further decreases in money market yields. Just how long would it take to recover lost income from waiting? Simply put, waiting could quate to lost opportunities and fails to maximize your investment potential.

Deferring investment carries various risks:

- Delays can cause missed gains if the market prices rises.

- Holding cash risks diminished purchasing power from inflation.

- You forfeit potential compound interest and lower overall returns.

- Inaction driven by fear can lead to missed opportunities.

- Economic changes might force you to enter the market under less favorable conditions.

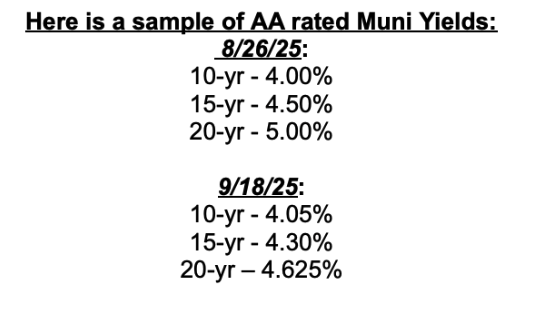

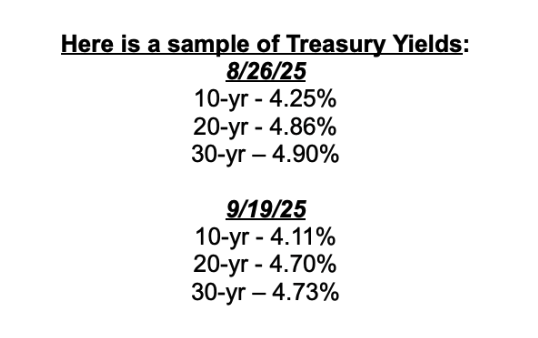

To highlight the cost of waiting and to prove the point, on August 26th we highlighted these points to our clients and gave a sample of municipal and Treasury bond yields that day. If you notice, yields dropped significantly in less than a month. (1)

Despite the drop in yields, there is still tremendous value in Munis relative to other asset classes. While volatility is likely to persist, it is important for investors to recall where rates stood before the COVID-19 pandemic. For example, on August 4.2020, the 10-year Treasury closed at .52%, today it is at 4.11%. Last year it dipped to 3.62% on 9/14/2024. (2)

All said, the cost of waiting is a real factor, the interest clock is always ticking so don’t allow your investment clock to run out on a valuable opportunity. Sign up here and let us put our 30+ years of municipal bond investing to work for you.

(1) Bond Yields

(2) Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity